In talking to Jessica Straus, Dundee Venture Capital’s new Venture Partner, it occurred to me that we should write an update on first fundings in what Straus called the “mighty middle”.

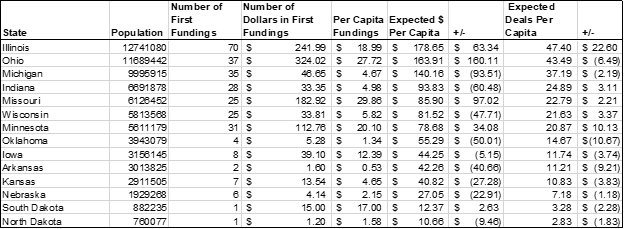

This paper describes first fundings. First fundings are a recordation of companies that raise capital for the first time. This paper uses Pitchbook data as its primary source, but the firm also looks at other sources including venture firm websites, SEC filings, and Crunchbase. The purpose of the paper is to identify the current state of affairs in the various Silicon Prairie states. By doing so, we believe that the general strength and weakness of states can provide insight into the region and potential opportunities for venture capital companies and entrepreneurs.

First fundings were about average in 2018. This is to say that on a regional basis excluding the top handful of fundings that are highly variable (often +$100mm fundings), the Silicon Prairie was approximately the same over the last five years. Certain states have seen increases or decreases, but the overall region is not experiencing a significant increase in the number or size of deals on average.

The region is again led by states with larger populations. However, this year Illinois, Ohio, Missouri, and Minnesota all outperformed expectations regarding the number of deals. And Illinois, Indiana, Missouri, Wisconsin, and Minnesota outperformed on the total amount of dollars deployed in first fundings. As with last year, Arkansas and Oklahoma were laggards, and Nebraska and Kansas underperformed.

One of the key findings in the data this year is that the smaller states continue to lag in first fundings. This suggests over the course of time that there are population gaps between the haves and have-nots. If we are to take this data as being representative, states with fewer than 5 million residents face a particular challenge in creating earlier stage capital sources.

Every single state in the region under-performs against the overall region’s expectations if they have fewer than five million residents. This suggests that these states should be particularly conscious of strategies to deploy early stage capital. Most of these states have programs – such as Invest Nebraska, i2e, etc. – but the suggestion from the data is that these programs may need to deploy even more capital and at an earlier point. One program that does not use state funds but seems to operate well and in this gap is BrightStar Wisconsin.

Individually the states have a variety of stories, but there are generally three groups of states.

The Haves

Illinois, with a strong concentration in Chicago, is the leading state in the region for first fundings. The state boasts a significant number of super fundings (over $10mm) and 2018 represents the overall five-year period well. From an expectation perspective, Illinois continues to overperform.

Ohio did not have its best year in 2018, but it remains in the top grouping. Despite slightly underperforming the total amount of capital deployed, Ohio remains the second strongest growth engine for the region. Columbus, Cincinnati, and Cleveland provide strong years throughout the five-year period that cross-support the overall effort of the state.

Minnesota is over-performing its total state population. But, Minneapolis-St.Paul as a region is one of the largest in the Silicon Prairie. Moreover, it is a hub to capital, particularly capital that is tied into healthcare, which represents consistent, large first fundings in the state. Thus, Minnesota has more deals with more capital than most of the other states in the region.

The Almost There

Four states are almost into the top tier of the region. Missouri outperforms but remains slightly below the first tier. It has been relatively consistent as a state, particularly St. Louis which represents nearly 70% of the overall state’s efforts. Part of that is the KS/MO split of Kansas City, but St. Louis continues to grow a strong foundation in first funded companies that continue to receive funding over time. In 2018, Missouri had more deals and more dollars deployed than was expected purely on population.

Indiana had a bit of a bump in 2018 that might be because 2017 was so strong. Overall, the trend appears up, but 2018 may be a signal to the state. Most of the funding in Indiana continues to be in Indianapolis, but there are strong pockets of research and development in other parts of the state that cause companies to grow in Indy. One noteworthy VC player in Indiana that has spurred the growth in the state is Elevate Ventures which is responsible for a particularly high number of the first fundings in the state.

Michigan is similar to Indiana in that 2018 may have been affected by 2017. However, in both years the number of deals were higher than the average over the last five years. That suggests that some of the rhetoric around Michigan’s rebirth may, in fact, be represented by these early stage companies. Like Minnesota, Michigan has a strong number of health care financings.

One of the states that is hardest to understand from the data is Wisconsin. From the numbers, it looks like 2014 was actually an outlier rather than a tick up for the state. In 2014, the state had a number of larger first fundings, totaling $167mm. Thus, despite being lower than 2014 in terms of real dollars, the state appears to be more healthy as it has more fundings than average and is around its average regarding the amount of dollars in its first fundings in 2018 compared to a longer-term view. However, Milwaukee still underperforms and this means that the state remains in the “almost there” category.

The Have Nots

Every state with fewer than five million people falls into the have not category. So, while some – Iowa, for example – perform better than others, they still underperform the overall region.

Iowa had a good, not great year. It was good because of IDx in Iowa City. This $33mm funding created a significant overall boost, but the state has only about ten first fundings per year on average. To make a jump the state needs to see more out of Des Moines and the western part of the state. Ames and Iowa City are outperforming similar communities in other states.

Despite relative strength in the Kansas side of Kansas City, the State of Kansas underperforms expectations. In 2018 only one deal that was captured in our data set took place outside of the KC metro area. Thus, other communities – Lawrence, Manhattan, and Wichita – need to pick it up for the state to recapture some of its early stage company growth reputation.

Nebraska had a very strong first part of the decade with a good first funding run from 2011-2015, but the last three years have been disappointing. Lincoln continues to lead Omaha in first fundings – both companies and dollars. For the state to grow, Omaha needs to perform better than it has in the last three years. Moreover, with recent exits from Flywheel and D3 Banking, there is reason to believe that more early stage dollars should be available in 2019 and 2020. The state needs to capitalize on this short-term opportunity by creating more funding resources.

South Dakota performs better than North Dakota, and together the two are comparable to states such as Nebraska. However, the data suggests that the states produce a single large funding every once and a while, but there are not enough smaller first fundings to build a consistent venture capital system. For purposes here, we have combined the two states for the graph, but actual data is SD (Yr/Deal/Amt in millions, ‘14/1/$2.06, ‘15/1/$1.1, ‘16/5/12.0, ‘17/0/0, ‘18/2/$15.1) and ND (‘14/u/u, ‘15/5/$14.5, ‘16/0/0, ‘17/0/0, ‘18/1/$1.2).

Oklahoma continues to be a laggard as a state. Its two largest cities – Oklahoma City and Tulsa – also under perform. One issue that Oklahoma is a primary example for is reported information. As we look at sources, actual activity appears to be significantly under-reported. This suggests that actual efforts in Oklahoma may be slightly better than the current picture. But, considering the state is significantly larger than many in this category, one would expect better performance overall. That being said, 2018 was a significant tick up from 2017 when there were fewer deals and dramatically less capital deployed in first fundings. So, it is possible that Oklahoma will move into the next grouping with an even better 2019.

The same cannot be said for Arkansas. It was a down year preceded by down years. Since 2014, Arkansas’ first fundings have significant decreased, cratering in 2018. The State of Arkansas deployed a lowly $1.6 million in capital to two deals – as first fundings. This may be a weak year, but the graph suggests a strong downward trend.

Conclusion

It bears more research to find out if there is a true distinction between states of more than 4-5 million and states of less than 4-5 million, but at least in 2018, the data strongly supports the need for small states to intentionally fund more companies early in their life cycle. While there are many models to support the proto-company – including good ones run by the States in Iowa and Nebraska – it appears that models like Brightstar and others may need to be created in some of the “Have-not” states.

Moreover, unlike 2017 when Indiana and Michigan had particularly strong performances, the Silicon Prairie in 2018 was pretty average compared to its last five years of first fundings.

If you are interested in this topic, please check out Pitchbook’s article: https://pitchbook.com/news/articles/21-charts-showing-current-trends-in-us-venture-capital.