NCR Corporation has acquired D3 Banking, an Omaha-based financial technology company for an undisclosed amount.

NCR announced the news in a July 2 press release. NCR is publicly traded on the NYSE under the ticker symbol – NCR. It has a current market capitalization of $3.7B according to the close of trading on July 2.

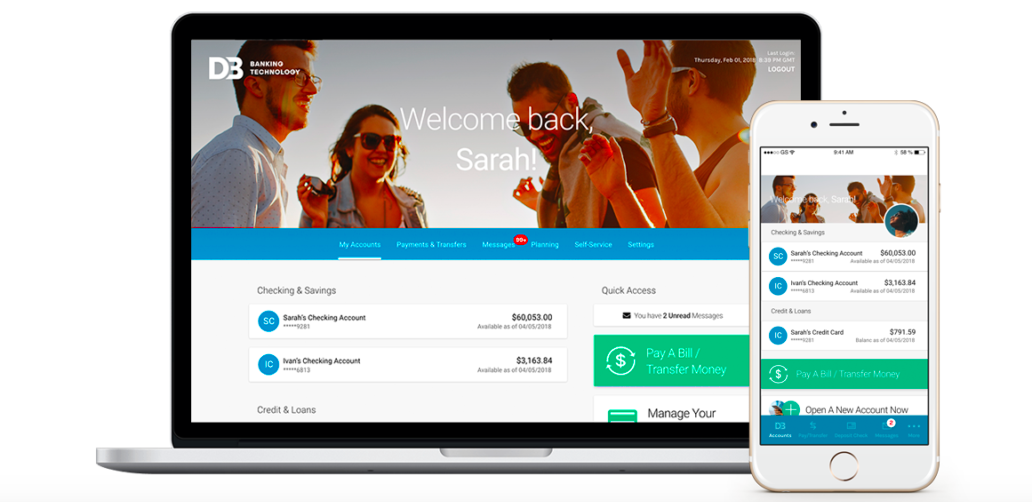

Omaha-based D3 Banking has become a leading financial technology solution for large banks. The company has built a broad-ranging platform that allows its customers to build both customized solutions and piggy-back on existing toolsets. For example, D3 Banking has integrated banking tools that allow the use of multiple functions on various form factors including computer, mobile, and watch.

The current digital platform integrates with existing offerings at many banks that can then be circulated through multiple channels to potential customers. D3 Banking also has significant reporting and analytics tools that allow banks the ability to better understand activity on their sites and with their customers. Current customers include First Tennessee Bank and Arvest Bank, among others, according to D3 Banking’s website.

In the press release, Mark Vipond, the Chief Executive Officer for D3 Banking, remarked, “D3’s customer-focused solutions have become a leading digital platform for large banks. NCR is a great fit for D3 and the timing is right for us to combine forces to create a powerful digital transformation platform for large financial institutions. This transaction enables us to capitalize on new market opportunities and bring top-tier capabilities to our mutual and future clients.”

According to Crunchbase, since its inception in 2005 as LoDo Software, the company has raised more than $38 million from a variety of sources – including West Partners, Treetop Ventures, Invest Nebraska, Linseed Capital, and Virginia based Route 66. According to Pitchbook, the company was valued in 2015 at $46 million dollars during its Series D round.

NCR Corporation is headquartered in Duluth, Georgia, a Northeast suburb of Atlanta. NCR was formed in the late 1800s and has been an active acquirer of businesses in the financial, retail, hospitability, telecom, and technology industries. The company has 34,000 employees and is active in 180 countries. In 2019, NCR has acquired three other companies – including OKI Brasil, Texas P.O.S., and Business Equipment Consultants.

NCR’s CEO is Michael Hayford. Regarding D3 Banking’s significant value-add to NCR, Hayford commented, “D3 has a well-earned reputation for innovation and product excellence and delivers one of the most advanced digital platforms for large banks. NCR’s Digital First Banking solutions help financial institutions connect with consumers whenever, wherever, and this acquisition helps NCR provide banks of all sizes with an exceptional digital experience.”

According to the press release:

“The expansion of NCR’s digital banking solution portfolio means that in addition to delivering one of the industry’s strongest solutions in the cloud for the Community Financial Institution (CFI) market, it can now provide a leading on-premise solution built for the needs of LFIs. NCR is a leading provider of digital banking solutions for financial institutions. D3 accelerates NCR’s Digital First Banking strategy, which includes integration of the customer experience across all self-service channels such as online and mobile banking, ATMs, Interactive Teller Machines and other Banking software solutions, complemented by NCR’s consulting, advisory and support services.”

The D3 Banking exit follows an active week in early-stage company news in the Silicon Prairie, with Flywheel announcing its exit on June 24. Click here for that story: https://spnewsnjt.wpengine.com/2019/06/wp-engine-to-acquire-omaha-based-flywheel/.

Silicon Prairie News will continue to cover start-ups in the Silicon Prairie. For more information on these acquisitions and more, follow us on Twitter and Instagram (@siliconprairie).