With no fewer than 32,000 business closures in the restaurant industry through the end of August—nearly 20,000 of them permanent, according to Yelp’s latest Economic Impact Report—the fragility of restaurateurs and similar walk-in businesses has been laid bare by the COVID-19 pandemic.

Even for establishments that sought to pivot to curbside pick-up and deliveries, the ability to manage customer payments often meant the difference between staying afloat or drowning in the uncertainty of the pandemic.

Thanks to the payment technology company CardFlight, based in Lincoln and New York, businesses across the country have found a lifeline.

“Years ago, we were focusing almost exclusively on dongle-type, on-the-go payments acceptance for people like chair-renting hairstylists and flea market vendors with smartphones,” said CardFlight Founder and CEO Derek Webster. “We’ve since expanded to every way a small business owner wants to take a payment, we want to have a solution for that.”

Founded in 2013, the company today enables payments for more than 60,000 merchants in all 50 states. Rather than aiming to be an edgy disruptor intent on upsetting the industry, CardFlight’s approach has been to build bridges. Its partners include banks and 10 of the top 25 largest merchant acquirers in the world, with partnerships including well-known players like TSYS and Fiserv, both of which have or have had strong connections to Omaha.

Said Webster: “We’re not very dogmatic about how our solution gets packaged and offered to the small business owner. We just give our partners the ability to customize it and that goes a long way in terms of being able to offer what works to their customers.”

Since late 2015, the company has operated an office in Lincoln, where payments industry entrepreneur Jesse Angell today leads a team of 15 employees focusing on software development, information security, and application infrastructure. Angell, who co-founded a small business- and nonprofit-focused payment processing solution acquired by Nelnet in early 2017, has spent the last decade in Nebraska, half of it helping build up CardFlight.

“Having lived here (in Lincoln) for this long, I’m able to connect with people and I get to tell them we’ve got the excitement of a startup but also the good, sound things an established business should have. That’s something people here appreciate because most of the startups they do see don’t last,” Angell said.

Given the capitol city’s proximity to the quiet-but-mighty payments hub of Omaha–industry pioneers like ACI Worldwide and the former First Data each got their start here, and Boston-based Toast is a relative industry newcomer with a presence in Omaha–it’s easy to assume that a company like CardFlight has access to a large pool of payments vets ready to jump ship. But Angell says that’s not really the case.

“It’s unlikely you’ll work with any other company that works with the specific tech and tech standards we do. From an engineering perspective, we’re open to people that have the right mind over the right kind of company on their resume,” he said of recruitment.

As for Webster, he prefers the balance provided by the New York-Nebraska connection: “It’s not NYC versus Lincoln, because as a corporation, we’re much stronger being in both cities than in one or the other.”

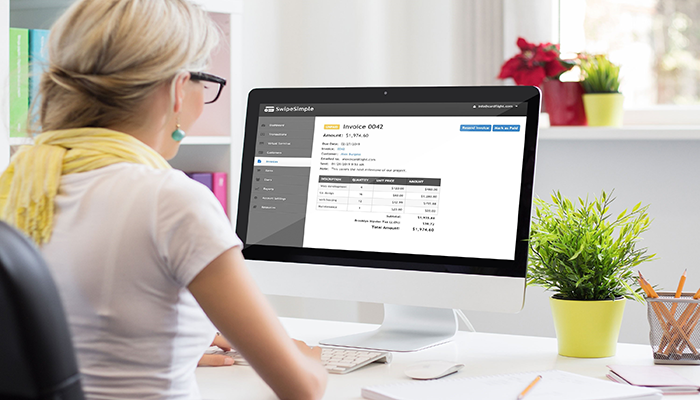

Looking forward, the company sees continued opportunities to keep helping small businesses grow. Once COVID started forcing businesses to shut their doors en masse–whether by choice or by mandate–many owners found themselves hamstrung mid-pivot by the traditional hardwired point-of-service terminal. CardFlight responded by launching invoicing software and a virtual terminal to enable phone payments.

According to the latest weekly insights harvested from data generated by users of CardFlight’s SwipeSimple platform, its customers are seeing upward movement in sales and transactions. The company’s small business indicators show that contactless payments through methods like Apple Pay and Samsung Pay are up nearly 183% when compared to pre-COVID levels. That kind of insight has even garnered the attention of Wall Street analysts, Webster said, but he’s more happy to be able to help customers survive uncertain times.

“Those small businesses were able to quickly adapt,” Webster said, “and I attribute our success to being very responsive to their needs.”