Introduction

Everybody knows venture capital is important. But how many of us actually understand it?

If you’re a long-time fan of Silicon Prairie News you’ve probably read about venture capital as a mechanism to fund early stage companies, i.e. funding announcements. If you work at a startup backed by venture capitalists, you might be familiar with the concept. However, conversations within the larger tech community suggest that there’s some confusion – and a desire to learn more.

Part of our mission for the relaunched SPN is to increase access and transparency around entrepreneurship and innovation in Nebraska. Taking a more equitable approach (no pun intended) means occasionally going back to basics to foster a shared understanding.

This Venture Capital Guide is our first educational resource. It’s goal: Demystify the world of venture capital.

Let’s go!

Venture Capital Overview

Venture capital is a form of financing specifically for early-stage or emerging companies with serious potential to grow. It involves investors providing funds to companies in exchange for equity ownership. Venture capitalists bring more than just capital to the table. They become strategic partners, providing guidance, industry insights and a network of connections to help startups scale their businesses. Venture capitalists shape the trajectory of these companies and participate in decision-making processes because they have a vested interest in the success of the companies they support.

It’s risky. It can also reward handsomely if the early-stage companies take off. Venture capitalists invest with the goal of exiting the investment within a few years at a higher valuation.

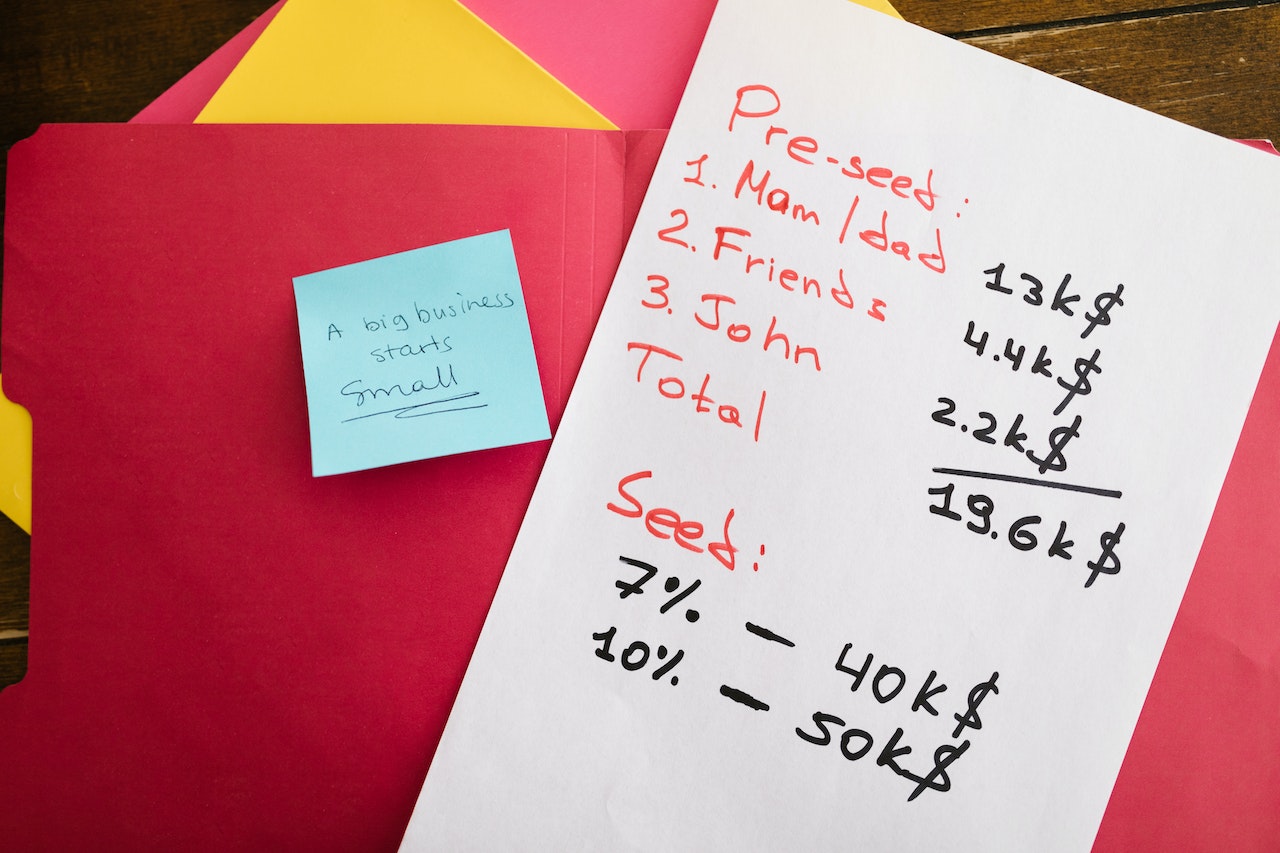

Venture capital investments typically occur through multiple funding rounds as companies progress and reach milestones. Pre-seed and Seed funding provide initial capital to transform ideas into viable prototypes, while subsequent rounds, such as Series A, Series B and beyond, support scaling operations, expanding market reach and attracting more investment.

Venture capitalists seek to realize their investments through avenues like initial public offerings (IPOs) or acquisitions. These exits, if lucrative, allow them to deploy capital into new ventures and fuel the cycle of innovation and entrepreneurship.

You can learn more about venture capital investments over the last decade in Nebraska companies in the 2022 Invest Nebraska Venture Capital Report. And by searching the SPN site archives.

Terms To Know

So what is…

Private equity – Investments made in privately held companies or assets not publicly traded on stock exchanges. These investors acquire shares of ownership in these companies with the goal of generating big returns through operational improvements, growth or strategic initiatives.

Venture capitalist – An individual or firm that provides funding to high-growth companies in exchange for equity ownership. They often also offer expertise, mentorship and industry connections to support the success of the companies they invest in.

Angel investor – Generally, high-net-worth individuals who invest their own money in very early-stage startups, often at the pre-seed or seed stage, in exchange for an equity stake in the startup. They typically invest a smaller amount, ranging from a few thousand dollars to several hundred thousand dollars, and at an earlier stage compared to venture capitalists.

Venture capital fund – A pooled investment vehicle formed by a group of investors, often managed by a venture capital firm, with the purpose of investing in early-stage or high-growth companies. The fund collects capital from limited partners and uses it to make equity investments in startups they like, aiming to profit when a successful exit event occurs.

Limited partner – An investor or entity that contributes capital to an investment fund, but has limited liability and limited involvement in the day-to-day operations of the fund. Limited partners typically provide funding to general partners or fund managers who make investment decisions for them.

General partner – An individual or team responsible for overseeing the operations of a venture capital fund. They make investment decisions, manage the investment portfolio, guide portfolio companies and work towards generating returns for the fund’s investors or limited partners.

Investment thesis – A guiding principle or strategic framework that outlines the criteria, focus areas and investment strategy of a venture capital firm. It defines the firm’s investment goals, such as target industries, stages of investment, geographic regions and key investment themes, to guide the decision-making process and align the firm’s investments with its overall strategy.

Carry – Also known as carried interest, it refers to the share of profits that venture capitalists receive as payment for their role in managing and generating returns on a venture capital fund. It represents the part of the profits distributed to the general partners of the fund as an incentive to succeed.

Equity stake – The percentage of ownership that a venture capitalist holds in a company in exchange for their investment. It represents the share of equity and associated rights, such as voting rights and potential financial returns, that the venture capitalist has in the invested company.

Dilution – Reduction in an existing shareholder’s ownership percentage in a company as a result of new equity issuances, such as subsequent investment rounds. When these new investors contribute capital in exchange for equity, the existing shareholders’ ownership stake gets diluted; their percentage of ownership in the company shrinks.

Portfolio – The collection of investments made by a venture capital firm or investor. It encompasses the various companies or startups in which the venture capitalist has invested. The goals: Diversify risk and potentially achieve big returns.

Deal flow – The volume of investment opportunities and potential deals presented to a venture capital investor or firm. It’s the pipeline of potential investments, including startups seeking funding, that the venture capitalists evaluate and consider for investment.

Due diligence – The comprehensive investigation conducted by investors on a potential investment opportunity before making a decision to invest. It involves assessing various parts of the target company, including its financials, business model, market potential, team, intellectual property, legal and regulatory compliance to evaluate the risks and potential returns associated with the investment.

Term sheet – A non-binding document outlining the key terms and conditions of a potential investment. It serves as a framework for negotiations between the venture capitalist and the target company, covering aspects such as investment amount, valuation, ownership stake, rights and preferences, governance and other important terms that will be further detailed in the final legal agreements.

Valuation – The process of assigning a monetary value to a startup company. It involves assessing various factors such as the company’s business model, market potential, competitive landscape, team, intellectual property and financial projections to determine its worth and negotiate the terms of investment.

Convertible note – A type of short-term debt instrument commonly used in early-stage financing. It’s a loan that can convert into equity in the future, typically when the company hits a big milestone, like a subsequent funding round.

SAFE note – Stands for “Simple Agreement for Future Equity.” It’s a financial instrument used in early-stage startup financing. It represents an agreement between an investor and a company, allowing the investor to contribute funds in exchange for the right to receive equity or a similar financial benefit in the future. Like a convertible note, it’s typically triggered by a big event. Unlike a convertible note, a SAFE note doesn’t accrue interest or have a maturity date.

Cap table – Short for capitalization table, it’s a record or spreadsheet outlining the ownership structure of a company. It specifically details the stakes held by various shareholders, including venture capitalists. It provides a snapshot of the company’s equity ownership, detailing the allocation of shares, percentages of ownership and any other securities or instruments that affect the ownership and capital structure of the company.

Runway – The length of time a company can sustain its operations with its current cash reserves without the need for more funding. It represents the projected duration, typically measured in months, before a company exhausts its available capital and would need to secure additional financing to continue its operations.

Follow on investment – Additional investment rounds made by existing investors in a company. It represents the decision by investors to provide additional capital to support the continued growth and development of a portfolio company beyond the initial investment round. It’s usually tied to the company meeting specific milestones.

Unicorn – A privately held startup company that has achieved a valuation of at least $1 billion. The term “unicorn” is often used to describe companies that have experienced rapid growth and success, capturing significant attention and interest from investors.

Exit – The (hopefully) big payoff, allowing investors to realize their investments and exit their ownership position in a company. It typically involves the sale of the company, an initial public offering (IPO) or other transactions that generate financial returns for the investors. It represents the culmination of the investment lifecycle.

Part 1 of the Venture Capital Guide provided an overview of venture capital and a list of related terms to know. Continue reading Part 2 where we define the multiple stages of startup funding, including characteristics of companies and investors at each stage, important milestones and typical funding amounts.

Let me know if there are specific terms or concepts you think should be added to Part 1! This guide is a collaborative work-in-progress.