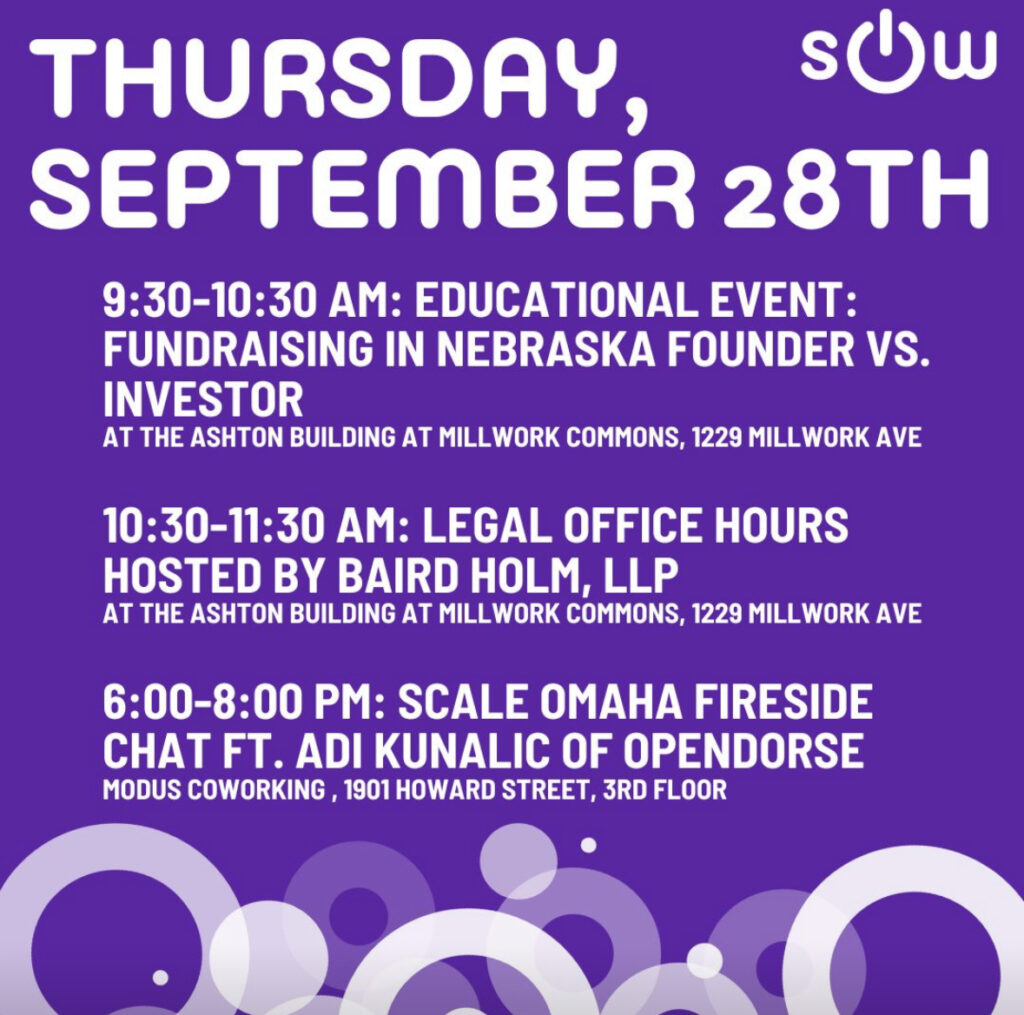

Keep reading to see key takeaways from the events on Day 4 of Startup Omaha Week.

Fundraising in Nebraska hosted by MOVE Venture Capital & Nebraska Startup Academy

This event was led by MOVE Venture Capital Managing Partner Charlie Cuddy and John Grange, a serial entrepreneur and general partner at MOVE VC. Here’s a summary of what they had to say.

Startup fundraising is the process of securing external capital to finance and grow a business. Adequate funding is key for scaling and moving quickly to try to gain a competitive advantage in the market. But before diving headfirst into fundraising, entrepreneurs need to ask themselves a critical question: “Should I even fundraise?”

One key takeaway for founders is that the most expensive dollar you’ll ever raise is the one you raise today. It’s essential to understand the various types of funding available, including venture capital, angel investors, crowdfunding, and more. Each has its pros and cons, and founders should carefully consider which option aligns with their business goals.

Tips For Preparing To Fundraise

Skills & Team: Founders need to be honest about their skill gaps and hire accordingly. This increases the chances for success, plus it’s a way to “de-risk” the venture for potential investors. Build a team with complementary skill sets.

Early-Stage Focus: Investors at the early stage look for these main elements: a strong team, a promising product and a market with customers. If you lack customers, the other aspects need to be exceptional.

Problem-Solution Fit: Is your startup addressing a problem people are willing to pay for?

Tech Expertise: Having someone technical on the team who can build the product or software is a significant advantage in the eyes of investors. Outsourcing the technical component will deplete capital quickly.

Market Strategy: Consider how you’ll acquire your first customer, followed by the 10th and the 1,000th. Understand your market size and pricing strategy in order to scale effectively.

Understand Your Gaps: Investors will scrutinize your startup for gaps and weaknesses, so it’s important to recognize and address them proactively.

Compelling Story: Craft a compelling narrative for your startup, but remember that your pitch to co-founders, customers and investors should be based in reality.

Tips For The Pitching Process

Tailored Pitches: Create different versions of your pitch deck for various situations, whether you’re presenting to an analyst, principal or managing director at a firm. Understand their expectations and tailor your narrative accordingly.

Persistence Pays Off: It generally takes talking to numerous investors before securing a “yes.” Use each interaction as a learning experience to refine your pitch.

Tiered Approach: Categorize potential investors into tiers A, B, C, and start by refining your pitch with tier B before moving to tier A (top tier). Practice is key.

Investor Updates: Keeping investors informed through regular updates is crucial, even before you have customers or revenue. It helps maintain their interest and builds trust.

Syndication: Investors often prefer to see multiple participants in a funding round. The more investors you already have committed, the more expertise and credibility you can demonstrate.

Scale Omaha Fireside Chat with Opendorse

Day 4 ended with the Scale Omaha monthly event featuring Opendorse Co-founder & President Adi Kunalic. Opendorse is a platform that connects student athletes with potential NIL (Name, Image & Likeness) opportunities and brand deals. We’ll post the video once it’s available.

In the meantime, here are a few takeaways from the conversation.

Complementary Co-Founders: One key takeaway from the Opendorse journey is the importance of having complementary co-founders. When co-founders possess different skill sets and can address distinct challenges, it helps prevent the redundancy of solving the same problems allowing for greater efficiency.

Teamwork & Understanding Roles: Being a good teammate means knowing where your strengths lie and recognizing who should be on the field when.

Surviving & Adapting: In the startup world the rule is simple: “Don’t die.” While it may sound straightforward, it often requires hanging on through tough times. Times like when the team only had 1-2 months of payroll left and had to figure out how to keep going.

The Evolving NIL Landscape: NIL is changing rapidly. That requires companies in the space to stay informed and adaptable. As of July 1, 2021, hundreds of new companies entered the NIL marketplace within months. Schools have been reluctant to engage with many of them due to compliance concerns, which has been a competitive advantage for Opendorse.

Financial Literacy & Empowerment: Beyond the platform’s core functionality of connecting student athletes with NIL deals, Opendorse also aims to educate athletes about financial literacy. The financial literacy component is important to help athletes make the most of their marketing opportunities.